Overview

What is a Balance Sheet?

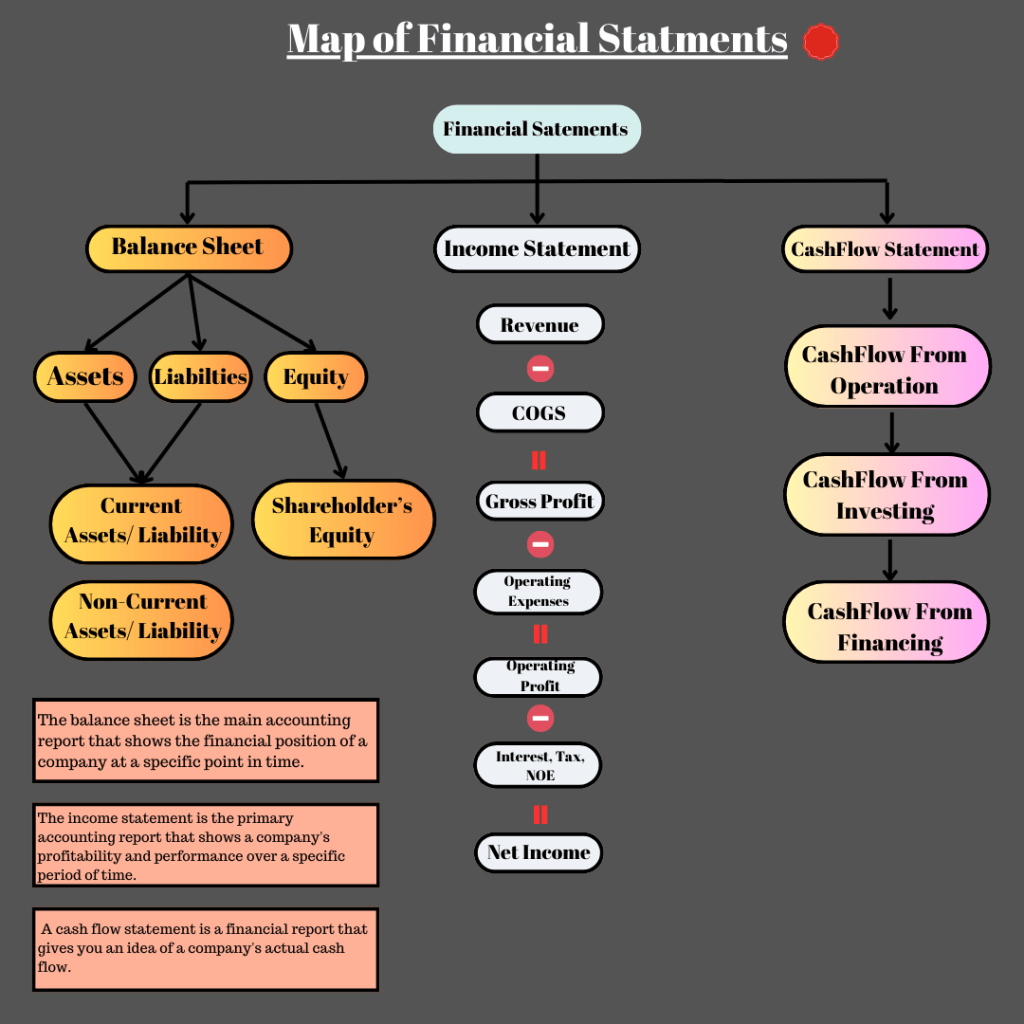

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time.

- Assets

- What a company owns that has value and can generate future benefits.

- Example: Cash, inventory, property, and equipment.

- Liabilities

- What a company owes to others, such as debts or obligations.

- Example: Loans, accounts payable, and mortgages.

- Equity

- The residual interest in the company after liabilities are subtracted from assets.

- Formula: Equity = Assets – Liabilities

- Example: Retained earnings and shareholder investments.

These three components form the foundation of the balance sheet equation:

Assets = Liabilities + Equity.

————————————————————————–

What is an Income Statement?

An income statement (also known as a profit and loss statement) is a financial report that shows a company’s financial performance over a specific period of time.

Revenue−Expenses=Net Income

Revenue (Sales): The total income earned from selling goods or services.

Cost of Goods Sold (COGS): Direct costs of producing goods or services sold.

Gross Profit: Revenue minus COGS.

Operating Expenses: Costs of running the business (e.g., salaries, rent, marketing).

Operating Profit (EBIT): Gross profit minus operating expenses.

Taxes and Interest: Costs related to taxes and borrowed funds.

Net Income (Profit): The final profit after all expenses are deducted.

————————————————————————–

What is a Cashflow Statement?

A cash flow statement is a financial report that shows the movement of cash in and out of a company during a specific period.

Cash Flow from Operating Activities

- Cash generated or used in the company’s core business operations.

- Example: Revenue from sales, payments to suppliers, and employee salaries.

Cash Flow from Investing Activities

- Cash spent or received from investments in assets.

- Example: Buying/selling property, equipment, or investments.

Cash Flow from Financing Activities

- Cash raised or paid to fund the business through debt or equity.

- Example: Issuing stocks, borrowing loans, or repaying dividends.

If you enjoy my blog, please don’t forget to like and share it with others who might find it helpful! Your support means the world to me. 🌟

On Instagram, I share bite-sized financial knowledge through easy-to-read flashcards. If you’re short on time, make sure to follow me at @Wealth_Path_Finder for quick and valuable insights. Let’s learn and grow together! 🚀

Leave a comment