Navigating the world of finance can feel overwhelming, but understanding key sectors is a game-changer for smarter money decisions. From everyday essentials to global innovation, the right knowledge can transform how you budget, invest, and grow your wealth.

In this post, I break down top sectors you should know about, giving you the tools to improve your financial literacy and build a more secure financial future. Ready to level up? Let’s dive in! 🚀

Overview

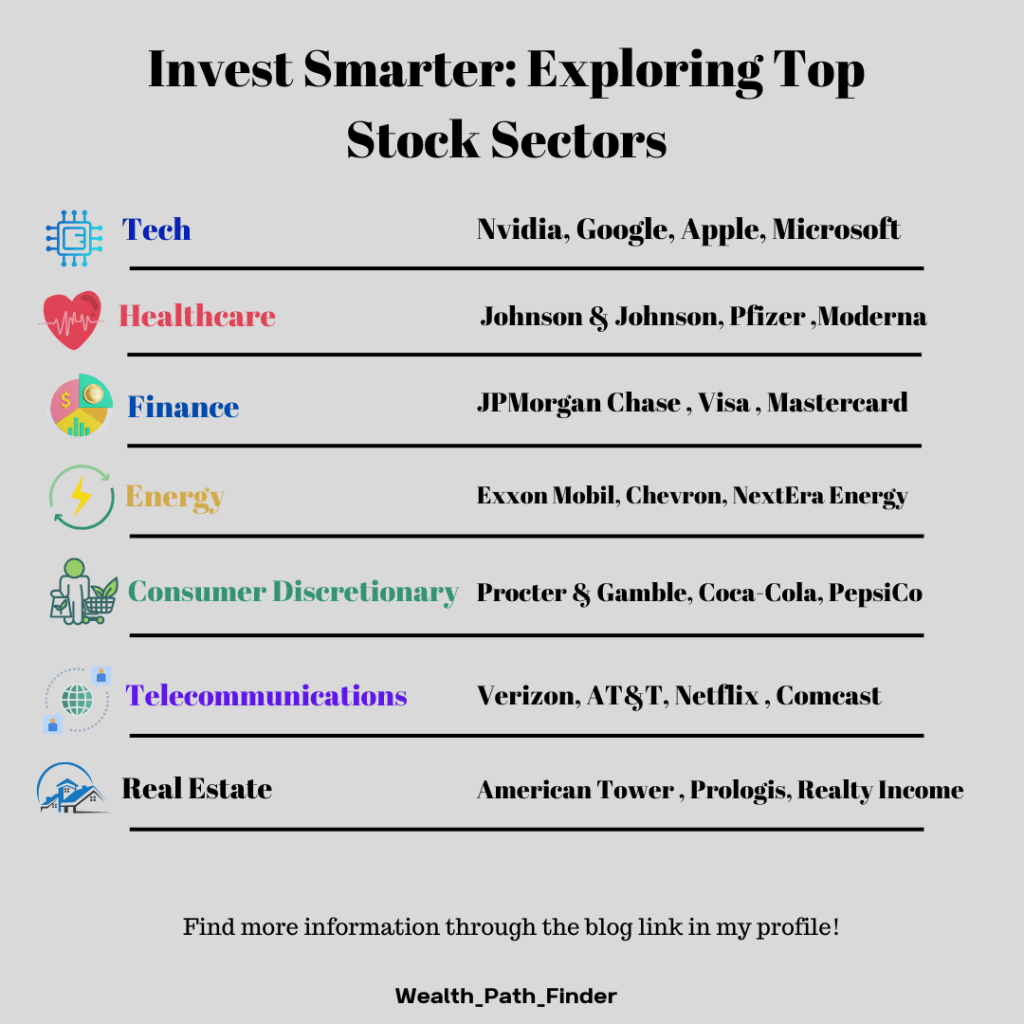

Tech

Pros:

- High growth potential driven by innovation.

- Strong global demand for cutting-edge technology.

Cons:

- High volatility with rapid price swings.

- Increased regulatory risks (e.g., data privacy, antitrust).

Healthcare

Pros:

- Stable profitability, especially in growing economies.

- High dividend yields provide steady income.

Cons:

- Economic downturns can severely impact the sector.

- Increased competition from fintech companies.

Finance

Pros:

- Steady income through high dividend yields.

- Benefits from rising interest rates, improving profitability.

Cons:

- Economic downturns can significantly impact revenue and stability.

- Increasing competition from fintech disruptors challenges traditional models.

Energy

Pros:

- Strong demand for traditional and renewable energy.

- High dividend yields for long-term investors.

Cons:

- Highly sensitive to price fluctuations (e.g., oil).

- Environmental regulations pose challenges.

Consumer Discretionary

Pros:

- Essential services ensure steady demand.

- Growth opportunities from new technologies like 5G.

Cons:

- High infrastructure costs for network expansion.

- Intense competition drives down prices.

Telecommunications

Pros:

- Consistent demand for essential communication services.

- Opportunities for growth with innovations like 5G and IoT.

Cons:

- High capital expenditure for infrastructure development.

- Price wars and competition can limit profit margins.

Real Estate

Pros:

- Steady income through rental yields.

- Long-term asset appreciation potential.

Cons:

- Interest rate hikes increase financing costs.

- Low liquidity makes it hard to sell quickly.

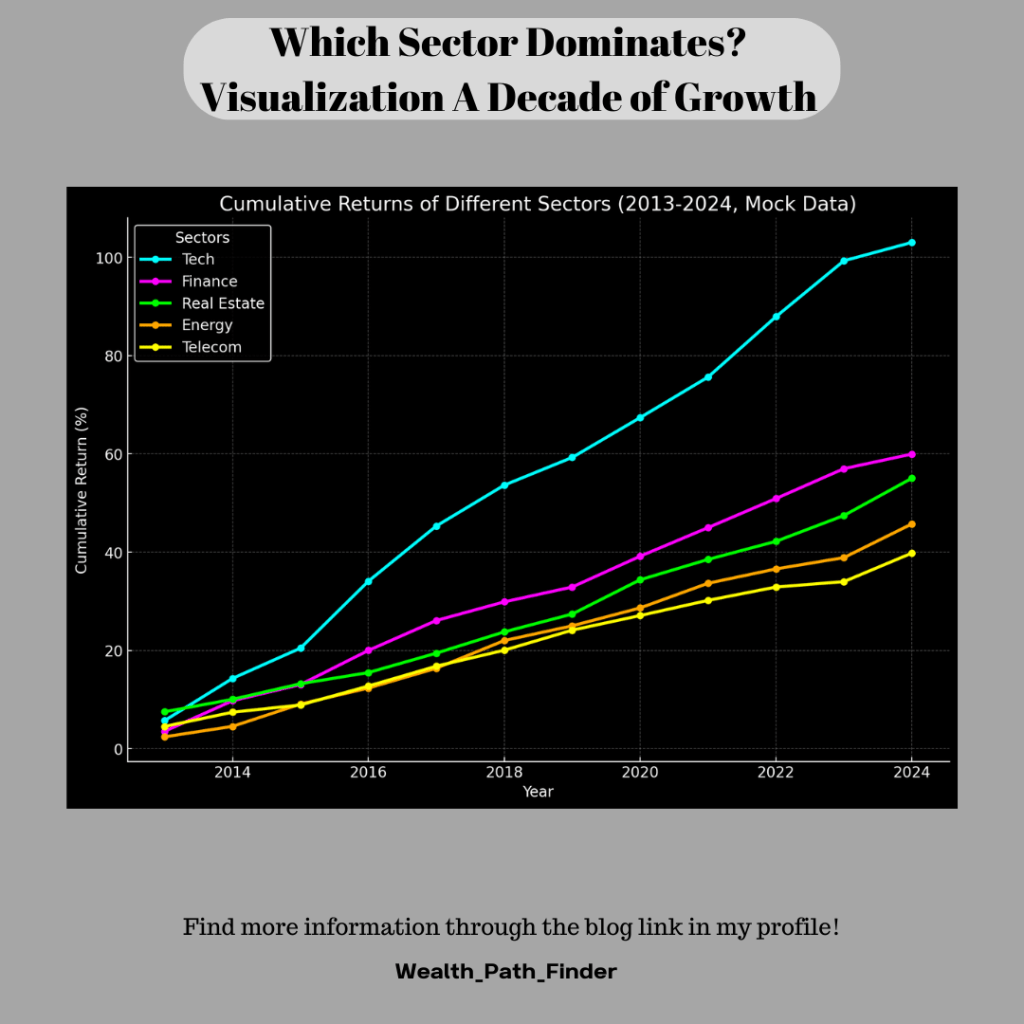

Understanding the strengths and weaknesses of each sector is key to making informed financial decisions. Whether you’re focusing on growth, stability, or long-term opportunities, diversifying across sectors can help you manage risk and maximize returns.

By improving your financial literacy and staying aware of market trends, you can make smarter choices for budgeting, saving, and investing. Ready to take control of your financial future? Start today—because the path to wealth begins with knowledge. 🚀

For quick and concise financial tips, follow me on Instagram @Wealth__Path__Finder!

If this blog helped you, please like or share it with others. 😊

Leave a comment