Dividend investing is a powerful strategy to generate a steady stream of passive income while building long-term wealth. Whether you’re new to investing or looking for a reliable way to supplement your income, dividend-paying stocks can be a great addition to your portfolio. This guide will walk you through everything you need to know, step by step.

What Are Dividends?

Dividends are payments made by companies to their shareholders, usually as a portion of their profits. Not all companies pay dividends, but those that do typically distribute them on a quarterly basis.

Example: If you own 100 shares of a company that pays $1 per share annually, you’ll receive $100 in dividends every year.

Why Companies Pay Dividends?

- To reward shareholders.

- To signal financial stability and profitability.

ㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡ

Why Invest in Dividend Stocks?

Dividend investing offers several benefits:

- Passive Income: Provides a regular income stream without selling shares.

- Compounding Growth: Reinvesting dividends allows your wealth to grow exponentially over time.

- Lower Volatility: Dividend-paying stocks tend to be more stable during market downturns.

- Long-Term Wealth Building: Consistent dividend payments can add significant value over decades.

ㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡㅡ

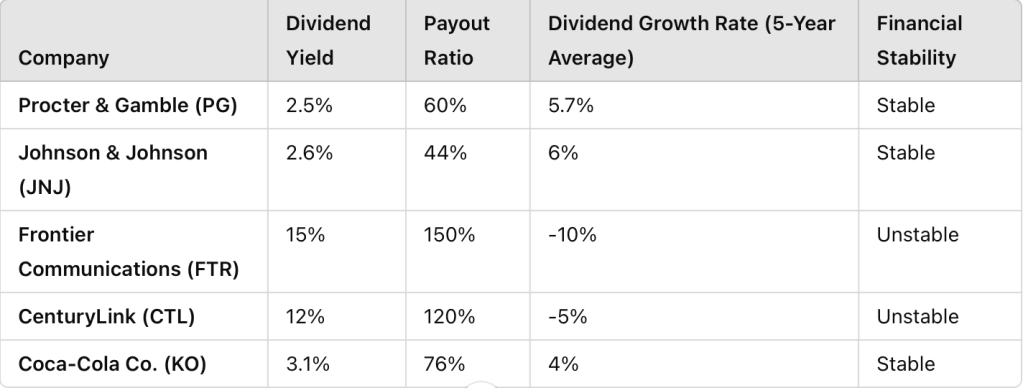

Key Metrics to Evaluate Dividend Stocks

- Dividend Yield : The annual dividend payment as a percentage of the stock price.

- Example: If a stock pays $2 annually and costs $50, the dividend yield is 4%.

- Caution: A high yield can indicate risk; balance yield with stability.

()

- Payout Ratio: The percentage of a company’s earnings paid out as dividends.

- Healthy Range: 30%–60% (Too high may not be sustainable, too low might mean limited growth).

()

- Dividend Growth Rate: The annualized growth rate of a company’s dividend payments over time.

- Why It Matters: Consistent growth shows the company’s commitment to rewarding shareholders.

()

- Company Stability

Look for companies with:

- Strong cash flow.

- Low debt-to-equity ratio.

- A history of consistent or growing dividends (Dividend Aristocrats are a good starting point).

Dividend Stock Evaluation Table

Common Pitfalls to Avoid

Dividend investing is not without risks. Here are some common mistakes to watch out for:

- Chasing High Yields: A very high dividend yield may indicate a struggling company. Look for balance.

- Lack of Diversification: Relying too heavily on one sector can expose you to unnecessary risk.

- Ignoring Fundamentals: Ensure the company has strong financial health and sustainable growth.

- To learn how to analyze a company’s fundamentals, check out the Free Financial Statement Course available on this blog. It’s the perfect starting point for mastering the basics!

How Much Can You Earn with Dividend Investing?

Here’s an example:

- Investment Amount: $10,000

- Average Dividend Yield: 4%

- Annual Dividend Income: $400

- Reinvesting that $400 and compounding annually can significantly grow your portfolio over time.

My Perspective on the Timing for Accelerating Wealth with Dividends

I believe the tipping point for significant growth in wealth through dividends occurs when the monthly dividend income equals or exceeds the price of a single share of the dividend stock. For example, if a dividend stock is priced at $48 per share, and you earn $48 or more in monthly dividends, you can reinvest those dividends to purchase at least one additional share every month—without contributing any additional funds. This creates a self-sustaining cycle where the dividends themselves fuel your portfolio growth. If you add extra funds each month, the process accelerates even further.

How Is This Achievable?

- Compound Interest as the Main Driver

- The principle of compounding enables your dividends to earn more dividends. As you reinvest, your total shares increase, boosting the dividend income generated in subsequent cycles.

- The Role of Dividend Growth Rate

- A rising dividend growth rate ensures that, over time, your dividend income increases regardless of additional contributions. The longer you stay invested, the greater the compounding effect, making dividend growth a powerful tool for wealth accumulation.

By leveraging these two factors—compound interest and dividend growth—you can significantly amplify your dividend income and create a compounding loop that accelerates your financial independence.

Leave a comment