How to Select Quality Stocks

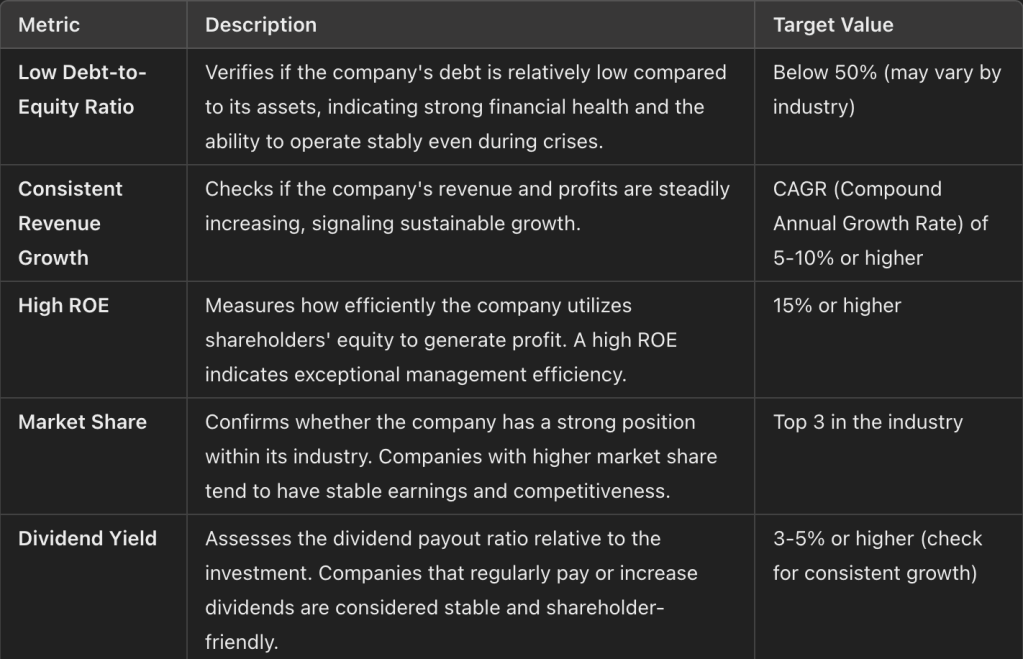

Information about selecting quality stocks using financial stability, market share, and dividend yield metrics can be easily found on various online platforms. For example:

- NerdWallet (nerdwallet.com): Provides beginner-friendly guides on how to analyze financial ratios like debt-to-equity and ROE when picking stocks.

- Investopedia (investopedia.com): Offers detailed articles on key metrics such as dividend yield, market share, and revenue growth to evaluate stock performance.

- Morningstar (morningstar.com): A trusted site for researching stocks with tools that provide in-depth financial data, market share insights, and company rankings.

These resources are excellent for learning about stock analysis and applying these metrics effectively.

Strategies for Finding Undervalued Stocks

- PER (Price-to-Earnings Ratio), PBR (Price-to-Book Ratio), PEG (Price/Earnings-to-Growth Ratio):

Use these valuation metrics to identify stocks trading below their intrinsic value compared to the overall market or industry peers. - Leverage Market Volatility:

Take advantage of market corrections or downturns to buy quality stocks at discounted prices. Identifying oversold opportunities can lead to significant gains when markets recover. - Industry Trend Analysis:

Focus on industries with high growth potential and identify strong companies within those sectors. For example, emerging technologies or industries undergoing structural changes.

Table: Metrics and Methods to Find Undervalued Stocks

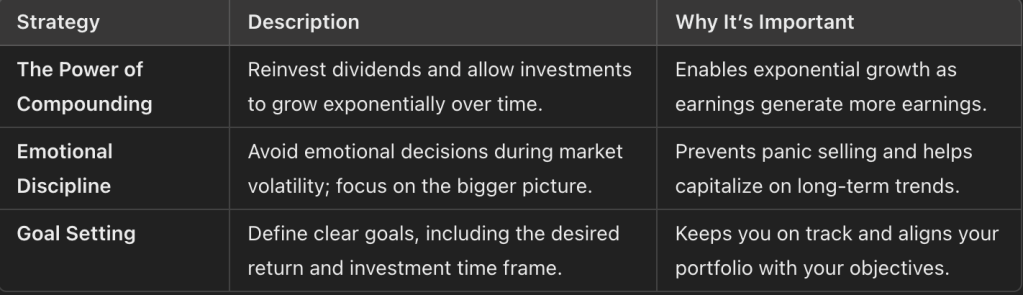

How to Maximize Returns with Long-Term Investing

- The Power of Compounding: Reinvest dividends and capitalize on stock price appreciation over the long term to maximize compounding effects.

- Emotional Discipline: Stay focused and avoid reacting to short-term market fluctuations. Consistency is key to long-term success.

- Goal Setting: Establish clear investment goals, including target returns and time horizons, to maintain a long-term vision.

Table: Strategies to Maximize Long-Term Returns

If you found this article helpful, please give it a thumbs up! Your support means a lot and helps us create more valuable content for you. 😊👍

If you have more to learn or questions while applying these strategies, feel free to leave a comment! We’d love to hear your thoughts and help you on your journey.

Leave a comment