Explore economic indicators and learn how to incorporate them into your investment strategies. Understanding these indicators not only enhances your investment decisions but also provides valuable insights into the overall economic landscape.

Table of Contents (click me)

Understanding the Concept of Economic Indicators

- Definition and significance of economic indicators.

Types of Economic Indicators

- Overview of the three main categories: Leading, Coincident, and Lagging indicators.

Overview Table of Economic Indicators

- Leading Indicators: Manufacturing PMI , Consumer Confidence Index, Stock Market Indices.

- Coincident Indicators: Retail Sales, GDP, Employment Levels.

- Lagging Indicaotrs: Consumer Price Index CPI, Unemployment Rate, Corporate Earnings

The Top 10 Most Practical and Widely Used Economic Indicators: Positive vs. Negative Trends

- This guide highlights 10 key economic indicators, their purpose, and their impact on the market. Whether you’re an expert or beginner, use these insights to make smarter investment and financial decisions.

Resources for Tracking Economic Indicators

- Recommended websites and platforms for reliable economic data.

(This is not an advertisement)

About this course

All the content here is focused on practicality, avoiding overly complex details. We have made every effort to ensure that even beginners can easily understand and approach the material.

If you find any inaccuracies or have topics you’d like to learn more about, feel free to reach out to (dhgustjd0552@gmail.com) or leave a comment below!

Definition of Economic Indicators

Economic indicators are numbers or data that show how well the economy is doing. They give information about important areas like how fast the economy is growing, how many people have jobs, how prices are changing (inflation), and how much people are spending or saving.

In simple terms, they help us understand the “health” of the economy and where it might be headed.

Significance of Economic Indicators

- Market Forecasting:

- Indicators help investors predict future economic trends and market movements, aiding in better decision-making.

- Risk Management:

- By understanding economic signals, investors can adjust their portfolios to mitigate risks during economic downturns.

- Informed Investment Strategies:

- Economic indicators provide data-driven insights that enable smarter allocation of resources across sectors and asset classes.

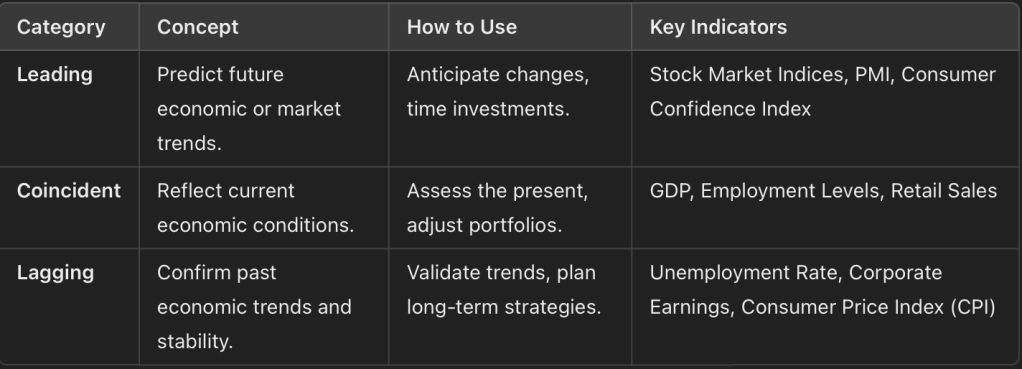

Types of Economic Indicator

1. Leading Indicators (Click here)

Definition: Predict future economic trends, moving ahead of the broader economy.

Purpose: Help forecast changes and guide proactive decisions.

Examples:

- Manufacturing PMI: Predicts production and economic activity.

- Stock Market Indices: Reflect future economic expectations.

- Consumer Confidence Index: Indicates future spending patterns.

2. Coincident Indicators (Click here)

Definition: Represent the current state of the economy, moving simultaneously with it.

Purpose: Provide a real-time snapshot of economic health.

Examples:

Retail Sales: Show ongoing consumer spending.

GDP: Measures current economic output.

Employment Levels: Reflect labor market conditions.

3. Lagging Indicators (Click here)

Definition: Confirm past trends and economic performance after they occur.

Purpose: Validate economic patterns and assess stability.

Examples:

Consumer Price Index (CPI): Reflects realized inflation levels.

Unemployment Rate: Tracks labor market trends after economic changes.

Corporate Earnings: Confirms profitability after market activity.

Overview Table of Economic Indicators

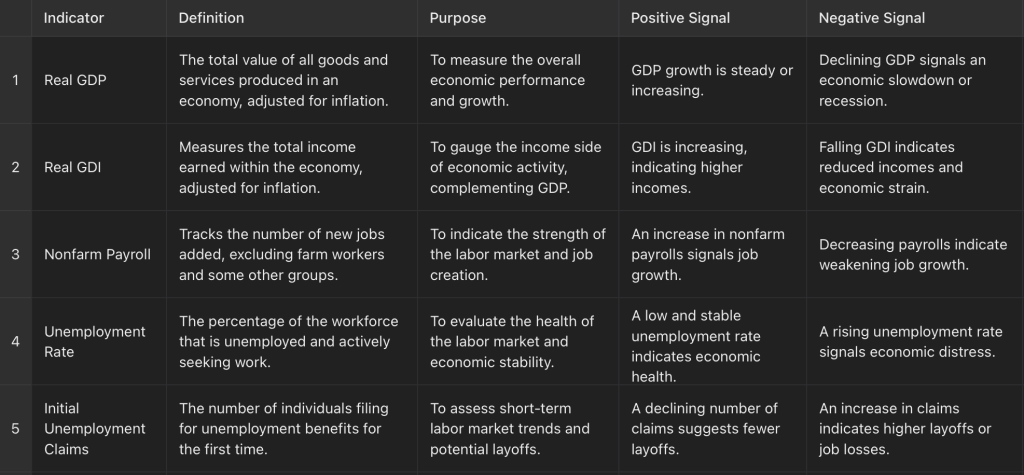

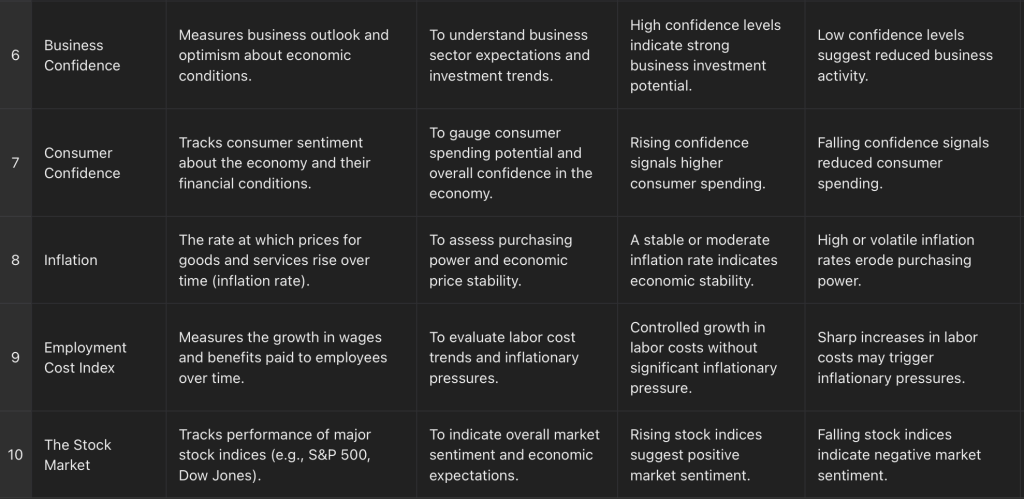

The Top 10 Most Practical and Widely Used Economic Indicators: Positive vs. Negative Trends

Economic indicators are essential tools for understanding the health and direction of the economy. This guide highlights the 10 most practical and widely used indicators, explaining their significance, how they are used, and what they signal about the market and broader economy.

How to Use the Economic Indicators Table (Click here)

This table provides a quick overview of 10 key economic indicators, their definitions, purposes, and signals for positive and negative trends. Here’s how you can use it effectively:

- Understand the Economy:

- Use the “Definition” and “Purpose” columns to grasp what each indicator measures and why it matters.

- Analyze Market Trends:

- Check the “Positive Signal” and “Negative Signal” columns to interpret the current economic conditions and predict market movements.

- Make Investment Decisions:

- Align your portfolio strategy with these indicators (e.g., rising GDP suggests growth-oriented investments, while high unemployment may signal caution).

Free Platforms to Track All Key Economic Indicators

FRED Economic Data (Federal Reserve)

- A comprehensive database for tracking indicators like GDP, unemployment, inflation, and more.

- Features: Customizable charts, historical data, and downloadable datasets.

- Covers global economic indicators, including GDP, employment data, inflation, and business/consumer confidence.

- Features: Live data, country-specific breakdowns, and forecast tools.

- Offers a real-time economic calendar covering indicators like nonfarm payroll, CPI, and unemployment claims.

- Features: Easy-to-navigate platform with explanations of each indicator and its market impact.

(The platforms mentioned above are provided solely for informational purposes. This is not an advertisement or endorsement, and we have no affiliation with these services.)

Conclusion

A Final Note on Economic Indicators

While these economic indicators are widely used and incredibly valuable, it’s important to remember that they cannot predict the market or economy with 100% accuracy. Markets are influenced by countless factors, including unexpected events, global trends, and investor sentiment, which indicators alone cannot capture.

That said, these indicators serve as powerful tools to analyze overall economic trends and identify potential investment opportunities. By using them as a reference, you can better understand the current economic climate, make more informed decisions about timing your investments, and spot shifts in market conditions.

Leave a comment