Personal finance is the key to taking control of your life, reducing stress, and achieving your dreams. It empowers you to make choices aligned with your goals rather than being dictated by financial constraints. By managing your money wisely, you can build wealth, prepare for life’s uncertainties, and turn your hard-earned income into opportunities. It’s not just about saving or cutting back—it’s about creating freedom, security, and a future you deserve. Start today, and take the first step toward a life of financial independence and peace of mind.

The 50/30/20 Budgeting Rule

The 50/30/20 budgeting rule, proposed by Harvard Law professor Elizabeth Warren, is a simple and effective way to manage your monthly income by dividing it into three categories:

- 50% for Needs:

Allocate half of your income to essential expenses like rent, groceries, utilities, and other necessities required for daily living. - 30% for Wants:

Use 30% for discretionary spending on things you enjoy, such as dining out, entertainment, hobbies, and travel. - 20% for Savings and Debt Repayment:

Save this portion for building an emergency fund, investing, or paying off debts like student loans or credit card balances.

Practical Example of the 50/30/20 Budget

Monthly Income: $4,000 (after taxes)

- Needs (50%): $2,000

- Rent: $1,500, Utilities: $200, Groceries: $300

- Wants (30%): $1,200

- Dining Out: $300, Streaming Services: $50, Travel: $500, etc.

- Savings/Debt (20%): $800

- Emergency Fund: $500, Student Loan Payments: $300

Adjusting for Real Life

With rising rent and grocery costs, our needs often exceed the 50% allocation. In such cases, we can adjust by cutting back on discretionary spending, such as dining out or entertainment, to maintain balance.

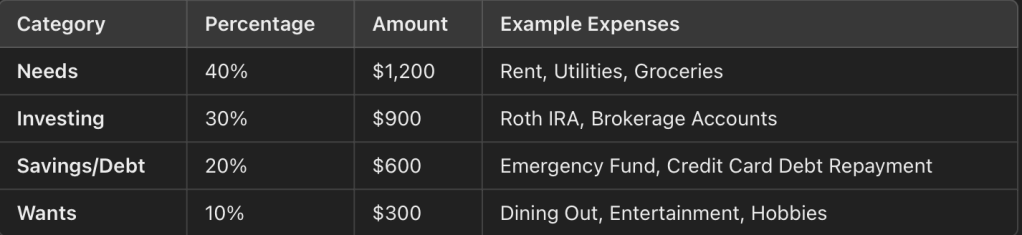

The 40/30/20/10 Budget for Aspiring Investors

If you want to prioritize investing while maintaining a balanced financial life, the 40/30/20/10 budget is a tailored approach. It ensures you’re actively investing while covering essential expenses and preparing for the future. Here’s an example based on a monthly income of $3,000

1. 40% for Needs ($1,200)

- Cover essential living expenses like rent, utilities, groceries, and insurance.

- Example:

- Rent: $900

- Utilities: $150

- Groceries: $150

2. 30% for Investing ($900)

- Allocate a significant portion to investments such as retirement accounts, brokerage accounts, or real estate.

- Example:

- Roth IRA Contributions: $500

- Brokerage Account Investments: $400

3. 20% for Savings and Debt Repayment ($600)

- Build your emergency fund or pay off debts like student loans or credit card balances.

- Example:

- Emergency Fund: $300

- Credit Card Debt Repayment: $300

4. 10% for Wants ($300)

- Spend this portion on discretionary activities like dining out, hobbies, or entertainment.

- Example:

- Dining Out: $150

- Subscriptions/Entertainment: $50

- Hobbies/Shopping: $100

Why This Budget Works?

Focused Investing: Dedicating 30% of your income to investments allows you to build wealth consistently.Balanced Approach: Your essential needs, future security, and lifestyle are all accounted for.Adaptability: Adjust the percentages as your income or financial priorities evolve.

Top 3 Free Asset Management Apps

(These apps are mentioned based solely on their features and practicality for personal use. This is not a sponsored recommendation, and there is no affiliation with the mentioned platforms. The suggestions are provided to help you explore tools that can support your financial goals.)

If there’s something you’d like to learn or know more about but prefer it neatly summarized for you, let me know! Feel free to leave a comment.

Leave a comment